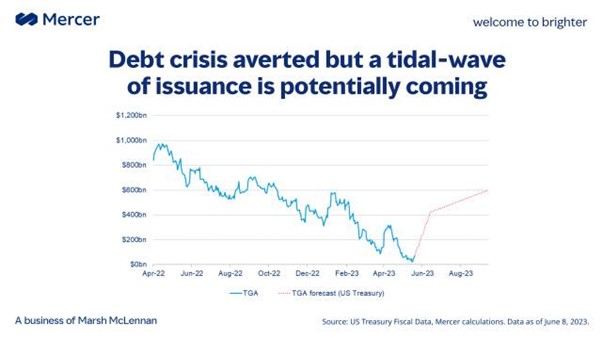

The U.S. debt crisis has been avoided, but the Treasury must urgently issue an avalanche of very short-term bonds to pay its bills:

How much money does the U.S. government need?

Initial estimates put the colossal figure at $550 billion, to be found immediately, starting this summer.

This figure does not take into account the exceptional measures put in place by the Treasury to continue operating during last spring's crisis, nor the $225 billion in short-term debt maturing this summer, which will have to be replaced by new borrowings.

JP Morgan estimates that around $1 trillion worth of Treasuries will have to be sold over the next few weeks.

Rates on these short-term loans are above 5%, but with inflation hovering around 4%, real yields are certainly not sufficient to attract sufficient demand.

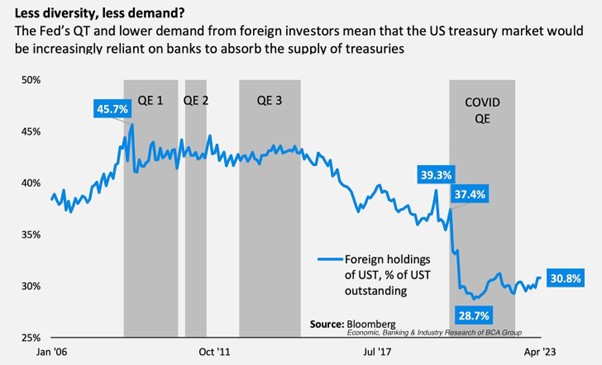

Foreign investors eased off during the Covid crisis, and their appetite for these U.S. bond products is far from back on the upswing:

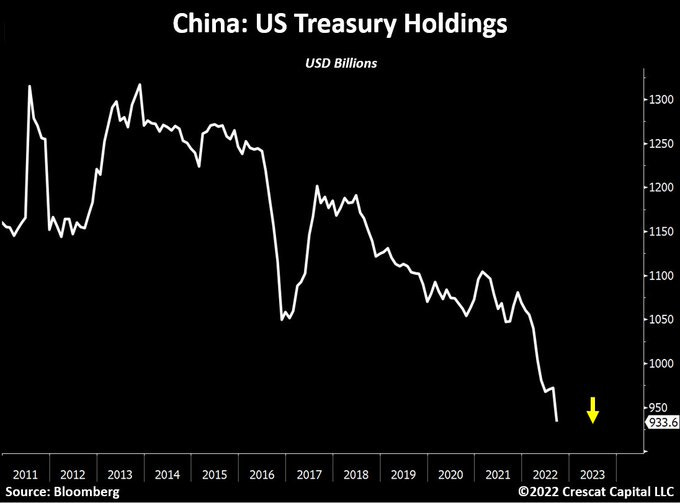

China continues to accelerate its sales of Treasuries:

The US Treasury will have to rely on other buyers.

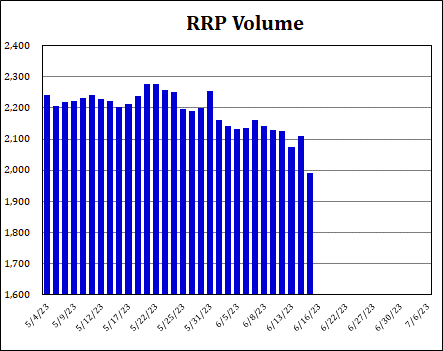

The Treasury can count on bank reserves held with the Fed: when rates were at zero, the Fed offered banks an opportunity for higher returns by increasing the interest on their reserves held in "Reverse Repos" accounts. These reserves now enable the banks to exchange this cash for Treasury bonds at higher rates. The amount of reserves held in Reverse Repos accounts is decreasing significantly as Treasury bonds are issued.

The banks also have their own reserves, estimated at $3 trillion.

When all reserves are taken into account, even if the amount of the Treasury auctions is colossal, there is theoretically enough liquidity available in the banks to absorb the avalanche of new Treasury auctions.

Nevertheless, raising the equivalent of a third of bank reserves on the market will not be without consequences for the availability of liquidity to the system as a whole.

This avalanche of new debt is being triggered at a time when other liquidity needs will very quickly arise from companies having taken advantage of the period of negative interest rates to borrow massively... but on increasingly shorter maturities.

The most fragile companies will soon be faced with a debt wall: refinancing these loans will have to be done in a market that is already very tight in terms of liquidity.

For the moment, the markets don't seem to be worried about this threat. On the contrary!

Global equity funds have attracted their biggest inflows in twelve weeks. In the week ending June 14, investors injected a net $16.18 billion into global equity funds!

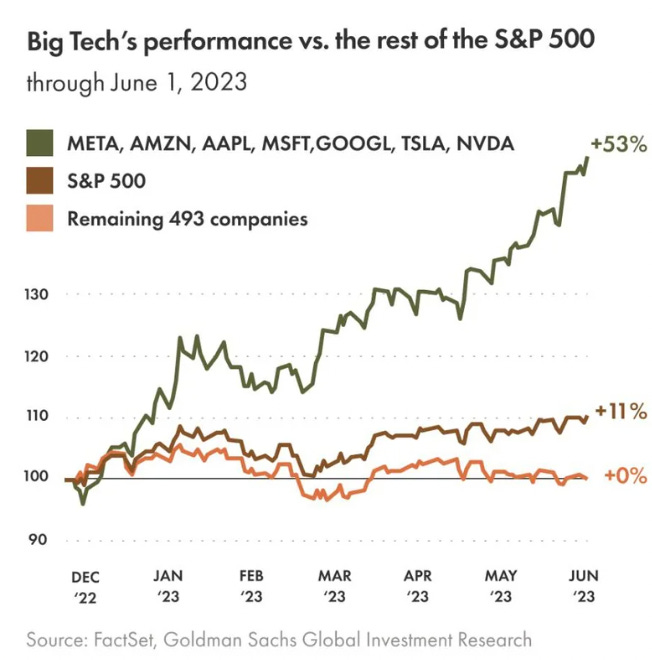

This inflow of capital was concentrated mainly on seven Nasdaq stocks: META, AMZN, AAPL, MSFT, GOOGL, TSLA and this year's star performer: NVDA.

The rest of the market is hardly benefiting from this stock market mania fuelled by speculation around Artificial Intelligence:

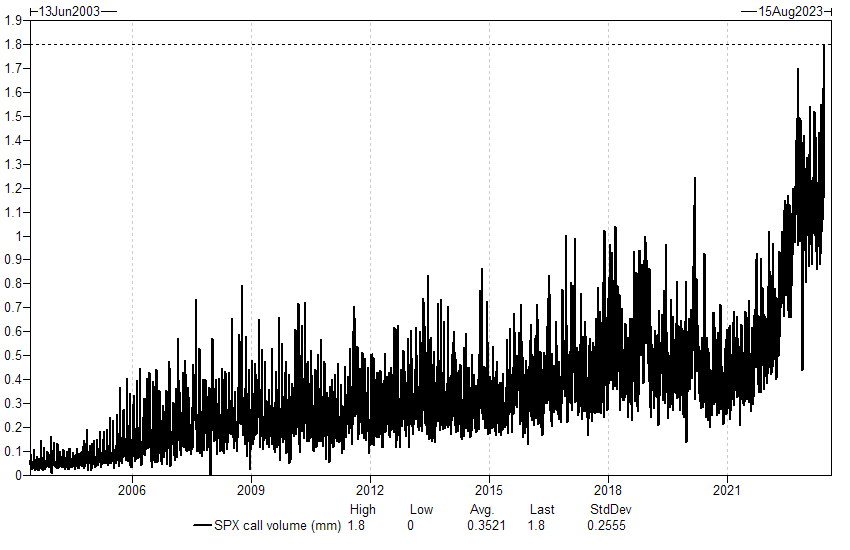

In a sign of the current speculative craze, the market has just seen an all-time high in call buying on the SPX:

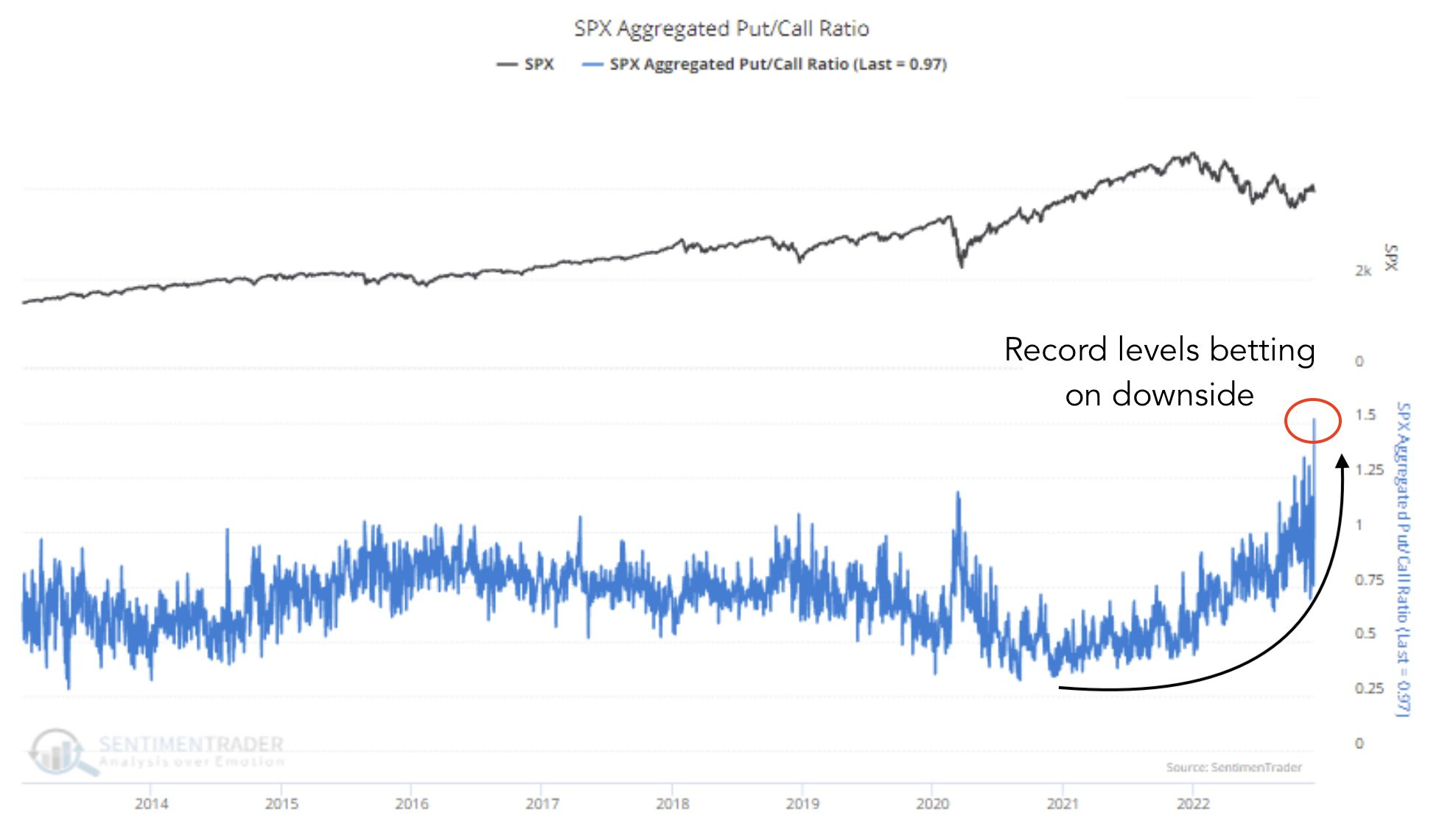

In my december macro newsletter, I published another record chart of inverse market sentiment:

At that time, there were a record number of bears on the markets. These bearish speculators of January have just experienced one of the biggest short squeezes in market history!

Just as the record number of bearish positions heralded a strong stock market rebound in January, the record number of bullish positions does not bode well for the coming months.

But not just yet!

The number of bears is still far too high. Clearly, there are still quite a few bearish positions to be liquidated!

A Bloomberg article reminds us that the number of bearish positions is now close to $1 trillion, and that these bearish positions are already sitting on potential losses of over $100 billion. There's still plenty of potential for short squeezes. In recent years, we've seen how derivatives can be used to create panic upswings. Some analysts are even predicting that we could see a general "gamma short squeeze" on much larger stocks than targets such as AMC (which had shown the power of these speculative raids).

The markets have become very dangerous, because leverage effects are very high, and cycles are determined by derivatives and are increasingly tight. Being right about a market downturn that could occur between now and 2024 can still mean losing a lot of money if a short squeeze occurs, forcing you to buy back your bearish positions!

Beyond the short-term risk of very high volatility, the fundamentals for companies (and therefore for markets) are deteriorating.

Even if the avalanche of Treasury auctions avoids a liquidity crisis by skilfully draining available bank reserves, the refinancing of corporate debt, at a time when this liquidity is being sucked up by Treasury issues, is likely to have immediate consequences for corporate margins: with higher refinancing costs at increasingly shorter maturities, companies will find it very difficult to get through the next few quarters.

But then again, timing is everything!

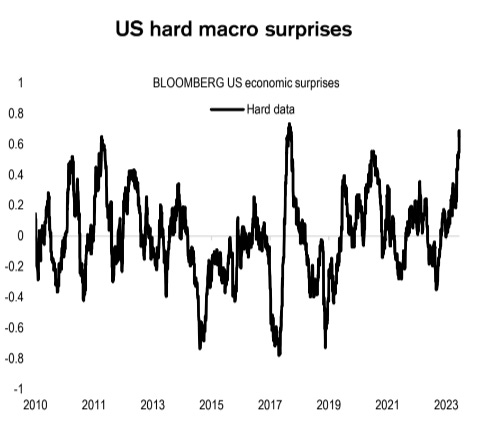

It's very difficult to imagine this scenario of falling activity with the current momentum. Consumer sentiment is holding up well, and the US economy is fairly resilient. New home construction is picking up. Almost all the figures released in recent weeks have been better than expected:

Unfortunately, the new refinancing conditions for corporate development do not allow us to hope for a continuation of the good shape of the US economy. While the markets may technically continue to appreciate in the short term thanks to speculative forces, on the ground, "Main Street" will very quickly find itself in a very bad position.

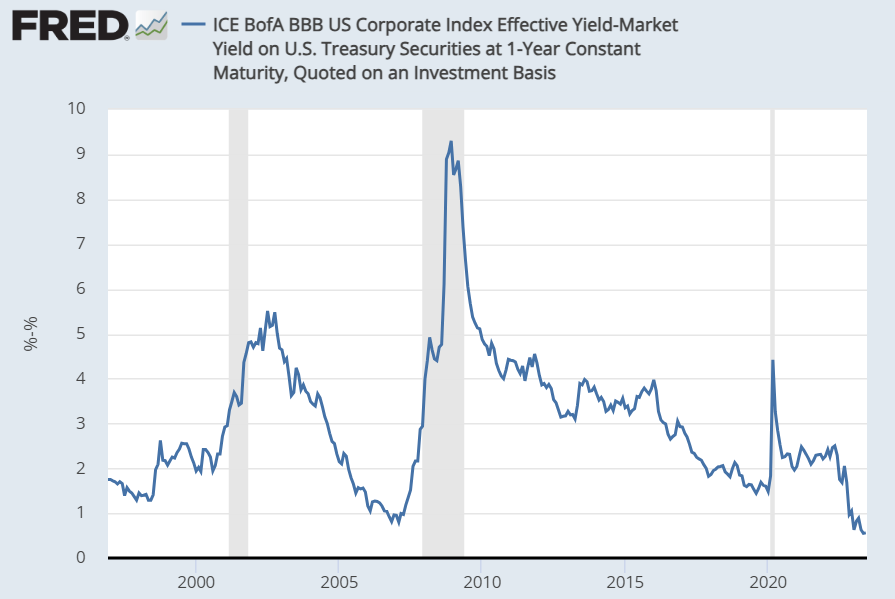

Not only is debt refinancing becoming more complicated, but available cash is being siphoned off by the liquidity vacuum represented by Treasury auctions. All the more so as the difference in remuneration between these products and the most speculative corporate bonds is at an all-time low:

Why invest in speculative corporate debt if you can have Treasury bonds offering the same yields, without the risk associated with the private issuer?

Not only will the cost of refinancing debt skyrocket for these companies, but the potential buyers of this new debt will simply disappear.

It is no doubt this gloomy outlook that is beginning to emerge in the latest business forecast figures published by Fedex.

Last April, I wrote: "The strong performance of Fedex, which many observers see as a sign of consumer resilience, confirms that consumer spending is holding up well in the U.S. for now. If the U.S. had entered a recession, Fedex stock would not have rebounded to the top of its uptrend channel."

Fedex's March forecasts predicted a resilient economy for the quarter.

This month, the tone has changed at Fedex... but not at the Fed! (if you don't mind my pun...).

Refusing to anticipate these deteriorating conditions in the real economy, Jerome Powell promises further rate hikes.

The Fed Chairman's firm stance is shared by all central bank governors: the Bank of England has just raised interest rates by half a percentage point. It has to be said that the UK is unable to control inflation, which is beginning to spread to service activities. The urgent need is to fight inflation. Central banks failed to anticipate the awakening of inflation and reacted far too late.

They now prefer not to anticipate the consequences of the brutal rate hikes they initiated and intend to continue.

These new rate hikes will complicate matters by increasing the government's refinancing costs: in the short term, this will accentuate the liquidity-sucking effect of ever-larger Treasury auctions, to the detriment of increasingly expensive and unaffordable private refinancing needs.

In any case, the Fed's tough talk is keeping real interest rates high:

Under these conditions, the gold price remains under pressure: as long as real rates are under threat of a significant upward breakout from this consolidation triangle, gold, which acts inversely to these real rates, is likely to break down its first support at $1,900:

In recent weeks, more and more speculators have been betting on gold's inability to hold this support.

But it is above all gold in euros that these speculators are hoping to see fall and reproduce the scenario of 2012: gold had corrected sharply (-30% in a few months) at that time. Such a move would bring gold back to around €1,400:

However, the current situation is not the same as it was in 2012. Today, the geopolitical context is tense, Europe's energy dependency is weakened, the German engine is at a standstill, demand for gold from BRICS central banks is high, and the debt levels of euro-dollar zone countries have exploded... It's not certain that such a bet against gold will be as profitable this time around.

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.