On July 27, figures released by the US administration showed GDP up by 2.4%, well above the 2% anticipated by analysts. The US economy seemed to be resisting the sharp rise in interest rates better than expected.

According to the Department of Commerce, the economy had shown few signs of recession in the second quarter, with US gross domestic product growing at a faster-than-expected pace over the period.

The announcement of the GDP figures had a strong impact on the markets. The dollar rallied strongly, enabling the Dollar/Yen chart to avoid breaking its support:

Gold plunged $50 in less than two hours:

On Wednesday August 30, a little over a month after these encouraging figures were announced, the administration published a terse correction: the increase in GDP was not 2.4%, but 2%. And when we analyze this figure in detail, we see that it is boosted by an inflated share of "public consumption".

So July's pleasant surprise was no surprise at all. Had the real figures been published in July, the markets would not have reacted in the same way.

The impressive resilience of the US economy seems to be coming to an end.

The effects of the rate hike are beginning to have a greater impact than expected. It remains to be seen whether the Fed's intended economic slowdown will turn into a sharp recession, or whether the soft landing scenario will be favoured.

In any case, the end of summer 2023 marks a clear change of tone in the United States.

The latest survey from the Federal Reserve Bank of Dallas shows that high interest rates are having an unprecedented impact on industrial production. Rising rates are yet another drag on industry. Coupled with problems linked to the relocation of heavy activities, the supply chain and the lack of skilled labor, high rates have created a situation where growth is being hampered by a sharp slowdown in industrial production.

The business leaders questioned in this study are calling on the Fed to stop raising interest rates, and to bring confidence to industrial sectors so that they can plan for growth.

The survey also reveals a broader decline in activity, with the exception of the automotive industry.

The automotive sector is experiencing the beginnings of a decline, probably in anticipation of possible UAW (United Auto Workers) strikes.

Another area of concern: revenues of US companies in China are particularly low, confirming the latest figures on the Chinese slowdown.

Here's an extract from one of the survey's testimonials:

"For the first time in a long time, we are seeing customers reduce or cancel orders due to softening end-use demand. We expect this trend to continue over the next few months. We continue to make capital investments, focusing on buying high-quality used manufacturing equipment at a discount when other people are pulling back because of uncertainty. Unfortunately, business is not good. Our sales team is working harder with less results. Projects are being postponed and, perhaps even more telling, payments are increasingly protracted."

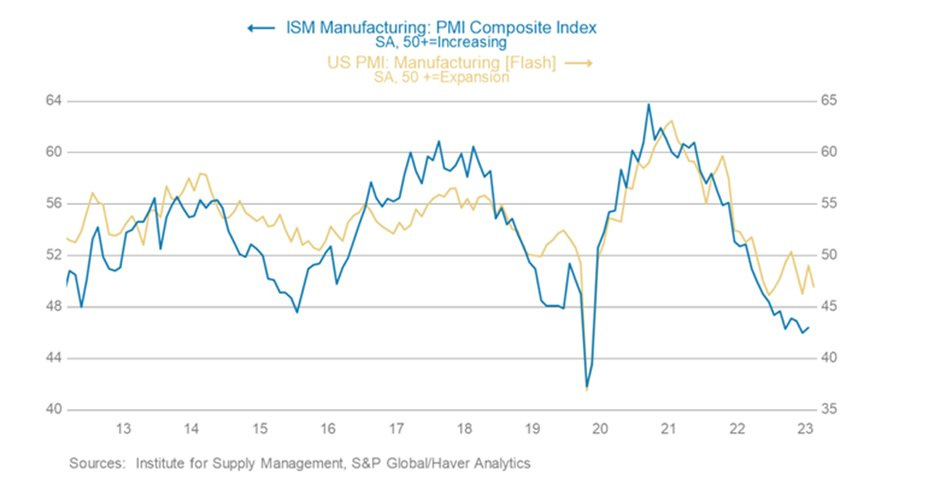

The US industrial sector has entered a contraction, with all indicators back in the red:

This slowdown in industrial activity had previously been overshadowed by the good shape of the service sector. But this is no longer the case. Since the beginning of the summer, the services sector has also been experiencing a marked slowdown:

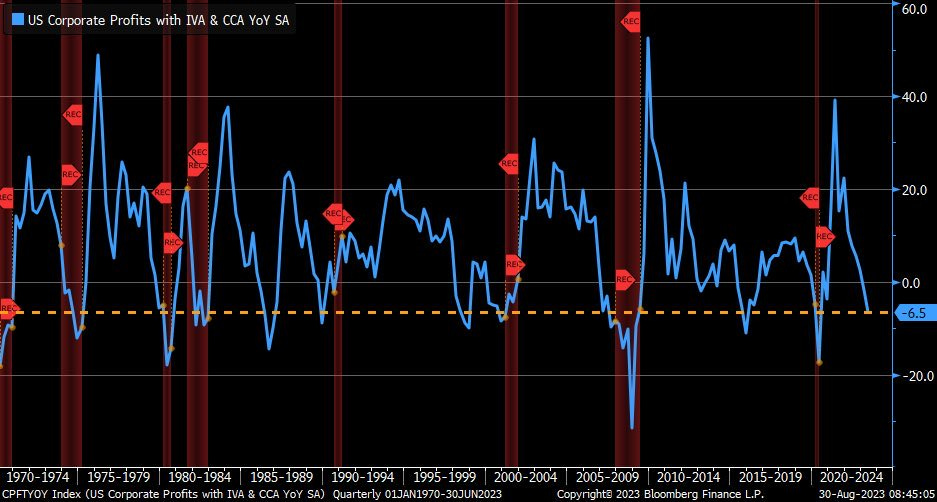

In recent months, corporate profits have fallen at the same rate as when the Covid-19 health crisis began:

In a warning issued at the beginning of the month, Danish container giant Maersk anticipates a sharp drop in global container demand this year. The decline is attributed to moderate economic growth and a reduction in customer inventories.

One of the world's leading shipping companies, with a market share of around 17%, is forecasting a drop of up to 4% in container volumes, compared with an earlier estimate of 2.5%. Its managing director Vincent Clerc sees no end in sight to the ongoing inventory reduction.

In other words, the global slowdown is now an underlying trend.

In Europe, the slowdown seems even more marked.

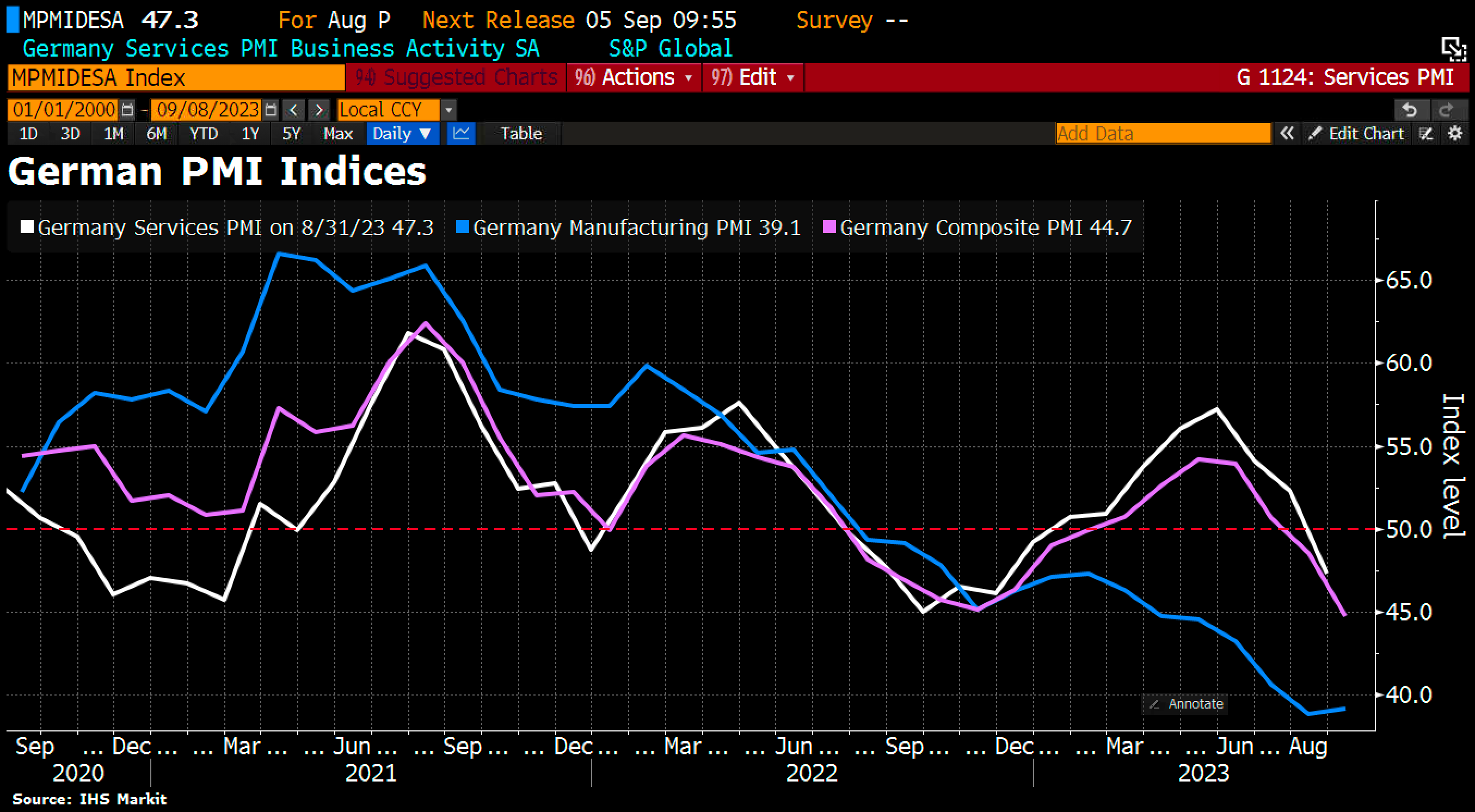

Germany seems to be the hardest hit by the global slowdown. The ISM services index fell in August, heralding a deeper-than-expected recession:

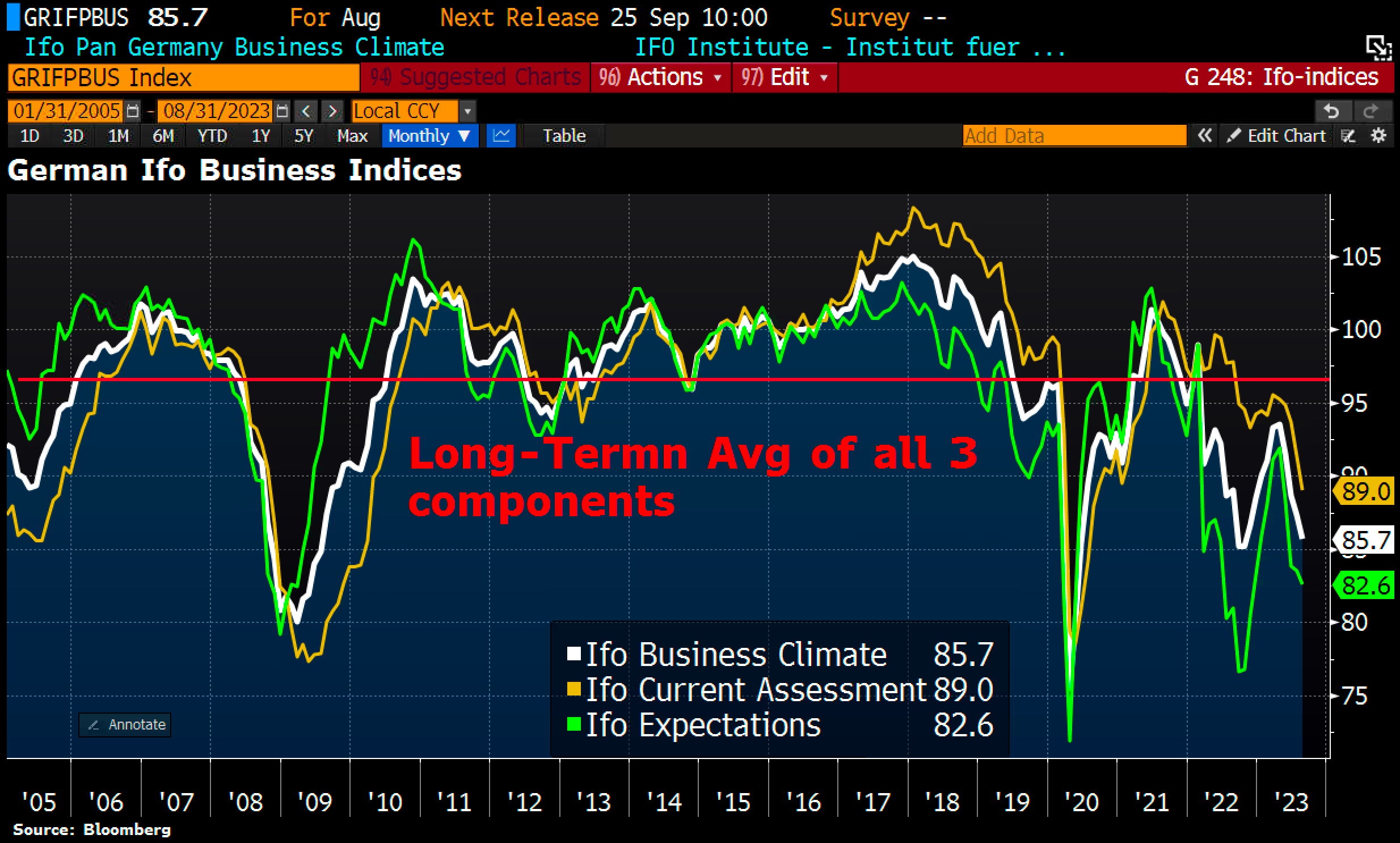

Business sentiment in Germany is worsening again, heading for the lows reached during the Covid crisis:

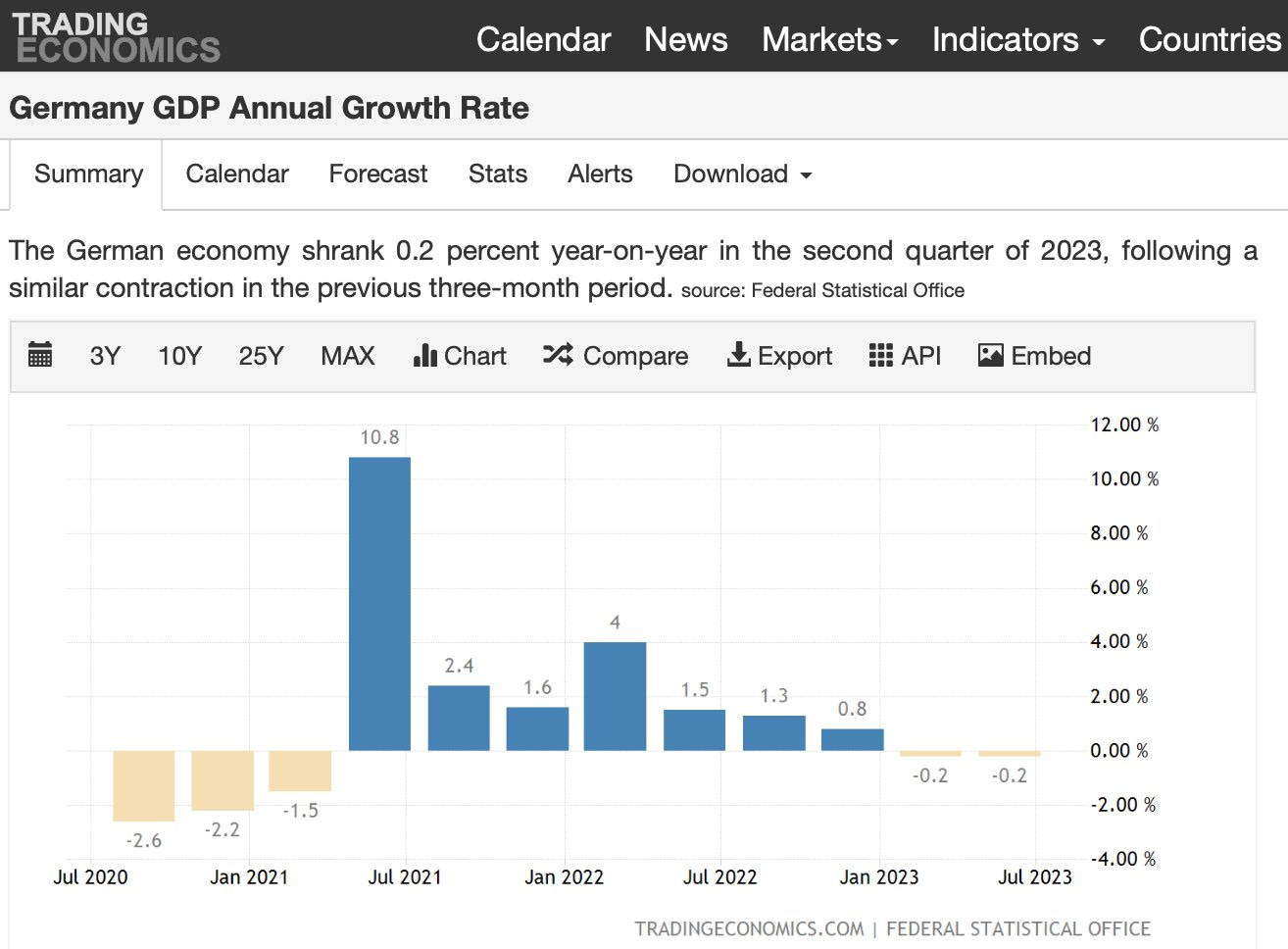

Germany is already officially in recession, but the drop in GDP is likely to worsen with the deterioration of these latest indicators:

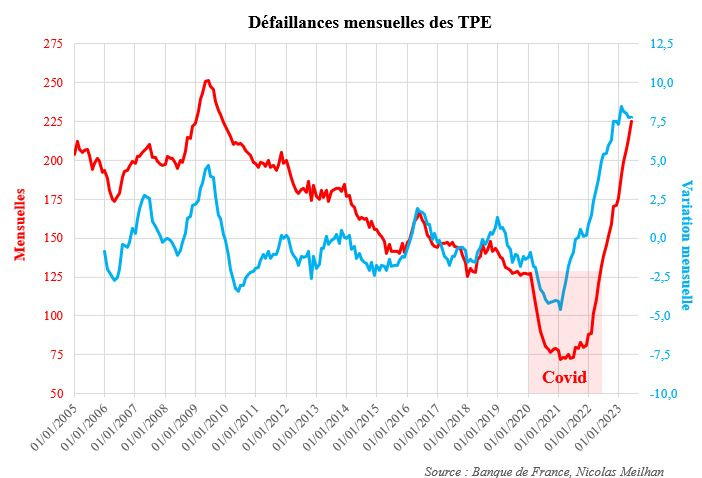

In France, the fabric of small and medium-sized businesses is worrying observers. The number of bankruptcies in this category has more to do with rising energy prices than with the effects of a real slowdown. France has a crisis on its hands!

The revision of US GDP logically boosts gold prices (without, however, erasing the artificial fall caused by the US administration's bogus figures in July).

But it's silver metal that is currently the focus of attention: for the fourth time since last May, silver prices are attempting to break through the bullish flag that has been in place since the summer of 2020:

Will silver finally succeed in breaking through this famous resistance?

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.