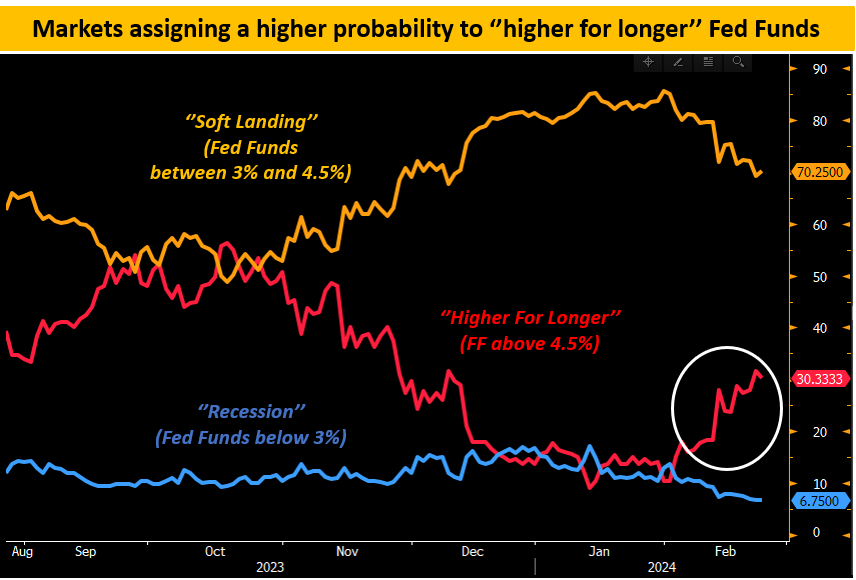

Market expectations regarding rate hikes have changed significantly since the beginning of February. Currently, the preferred scenario is that of a soft landing for the US economy, while the prospect of a recession is now largely dismissed by most analysts. Also, more and more analysts are forecasting that rates will remain above 4,5% for a longer period than initially anticipated.

This time last year, markets were expecting three rate cuts by May 2024. These are now expected much later. The market is not expecting a rate cut next month, and the one planned for June is even being called into question.

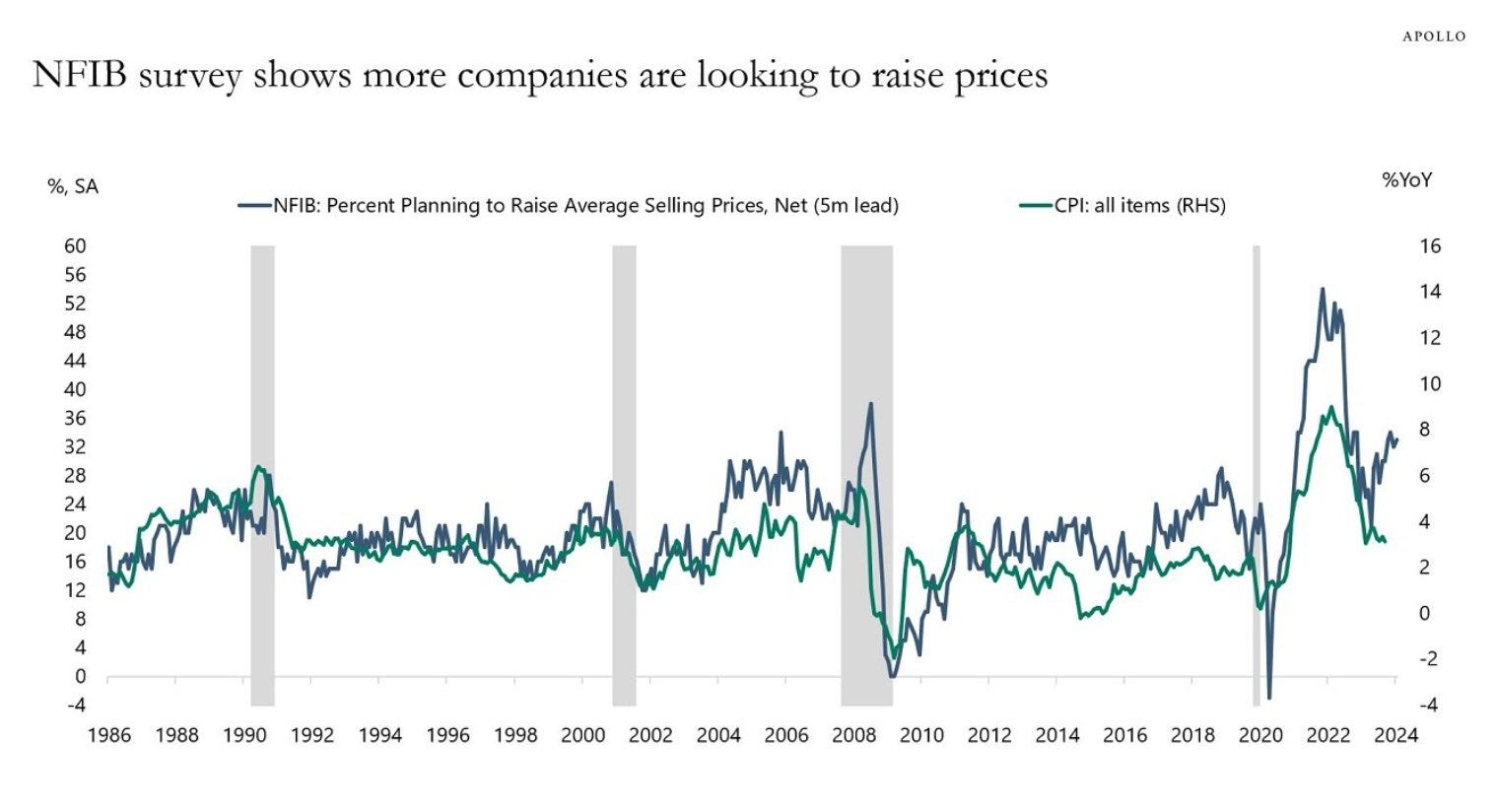

It's worth noting that inflation forecasts are on the up again. Although the latest CPI figures have fallen back from their 2023 highs, the outlook for price rises is on the up again:

Against this backdrop, the Fed will find it hard to justify cutting rates as early as next month.

The prospect of a longer-than-expected period of high rates should have a significant impact on certain segments of the economy.

But here again, markets seem to have modified their expectations since last year.

In 2023, the anticipation of a period of high interest rates led most observers to expect a recession.

This time, observers are reacting inversely.

The US economy is perceived as sufficiently robust to cope with this period of high interest rates, and recession expectations are currently at their lowest.

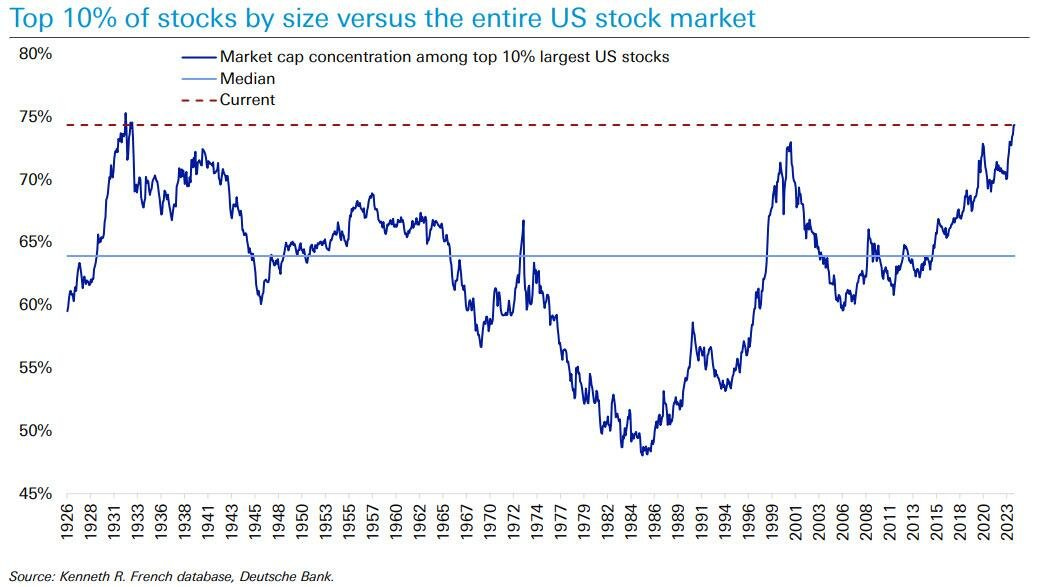

Markets are soaring, buoyed by the exceptional performances of the "Magnificent 7", which are setting record after record.

Virtually no fund is currently betting on a US recession, a trend reflected by the low level of bearish positions on these seven iconic stocks:

This market euphoria is benefiting insiders, who are taking advantage of recent rises to make substantial cash outflows.

The Bill and Melinda Gates Foundation recently sold shares in Microsoft. Jamie Dimon made his first sale of JPMorgan Chase ($JPM) shares since 2005, for $150 million. Mark Zuckerberg sold over $400 million worth of Meta shares, while Jeff Bezos sold $8.5 billion worth of Amazon shares. Lilly Endowment also made sales, parting with $130 million in Lilly shares. Alex Karp sold $25 million worth of Palantir shares. Finally, McDermott recently sold shares in ServiceNow for a total of $26 million.

When we say that the markets are benefiting from this new positive outlook, we are in fact talking about a very small part of the index. Bullish speculation is mainly confined to large-cap stocks, with a particular infatuation for flagships such as NVIDIA. This trend has brought market concentration to the same level as before the Great Depression of 1929:

European markets are also up, despite a very different economic situation.

Germany's GDP was held back by a drop in investment in the fourth quarter, putting Europe's largest economy on track for its first recession since the pandemic. Investment in machinery fell dramatically, down 3.5% on the previous quarter:

Although Germany is on the road to recession, the DAX reached its all-time high:

This disconnect between the financial markets and the economic situation is surprising at the start of this year.

The resilience of the US economy to the long period of high interest rates is buoying US markets, and this good form is having a contagious effect, affecting other markets that are nonetheless facing more difficult economic contexts.

The rise in the markets is accompanied by a new wave of speculation in crypto-currencies. Since the introduction of ETFs linked to these stocks, Bitcoin has soared by almost 100%, resuming one of its usual phases of bullish mania:

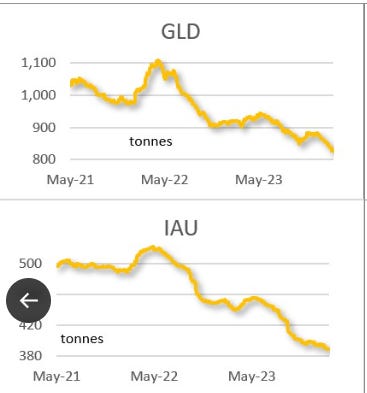

As markets rise and crypto ETFs soar, gold-linked ETFS outstandings continue to fall. GLD reserves have shrunk by 300 tons in just two years:

Western investors' disinterest in gold is also reflected in the desertion of the gold mining sector.

The GDX index, which assesses the performance of these mining companies, is once again at its lowest levels:

Newmont, the sector's leading company, reached its lowest level in five years after announcing a cut in its dividend:

Mining companies are suffering from the loss of investor appetite for gold.

Gold is currently supported solely by physical demand from two distinct categories: Chinese investors and BRICS central banks.

These central banks are continuing their purchases and demanding immediate delivery of physical gold.

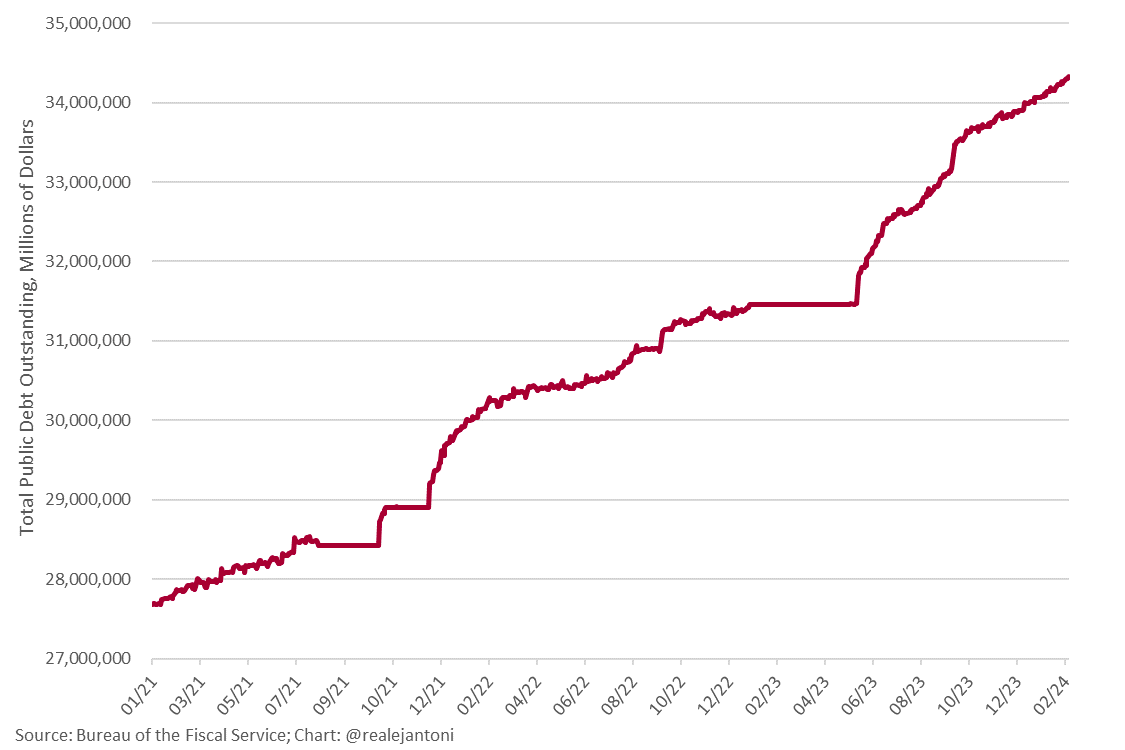

US debt is on the rise again. This is nothing new, as the upward trend in public debt goes back several decades:

But there's an important difference this time.

The upward acceleration in US public debt now coincides with an explosion in the interest paid by the Treasury. Keeping interest rates high is accentuating the debt burden, leading to a depreciation in the value of US bonds.

BRICS central banks are replacing their reserves invested in products that have become at risk of capital loss (Treasury bills) with physical gold. This is a capital preservation measure for their reserves.

The fact that the gold price remains above the $2,000 mark reflects concerns about US monetary and fiscal policy.

Will Western investors continue to shun gold?

The changeover to gold will occur when the market realizes, as central banks have anticipated, the inevitable dead end of this headlong rush into monetary and fiscal policy in the USA. This trajectory can only lead to recession or stagflation (which would not necessarily be an official recession, but a real inflationary recession).

Reproduction, in whole or in part, is authorized as long as it includes all the text hyperlinks and a link back to the original source.

The information contained in this article is for information purposes only and does not constitute investment advice or a recommendation to buy or sell.