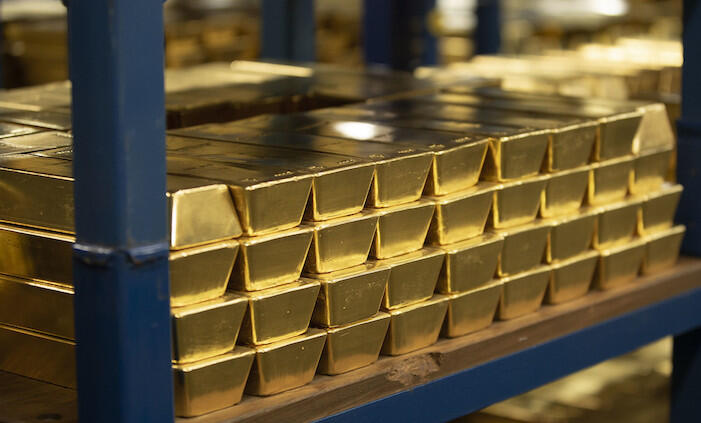

The World’s Best Kept Investment Secret Is Gold

The world’s best kept investment secret is GOLD: Gold has gone up 7.5X this century, gold Compound annual return since 2000 is 9.2%, Dow Jones Compound annual return since 2000 is 7.7% incl. reinvested dividends.So why are only 0.6% of global financial assets in gold? The simple answer is that most...

Read article